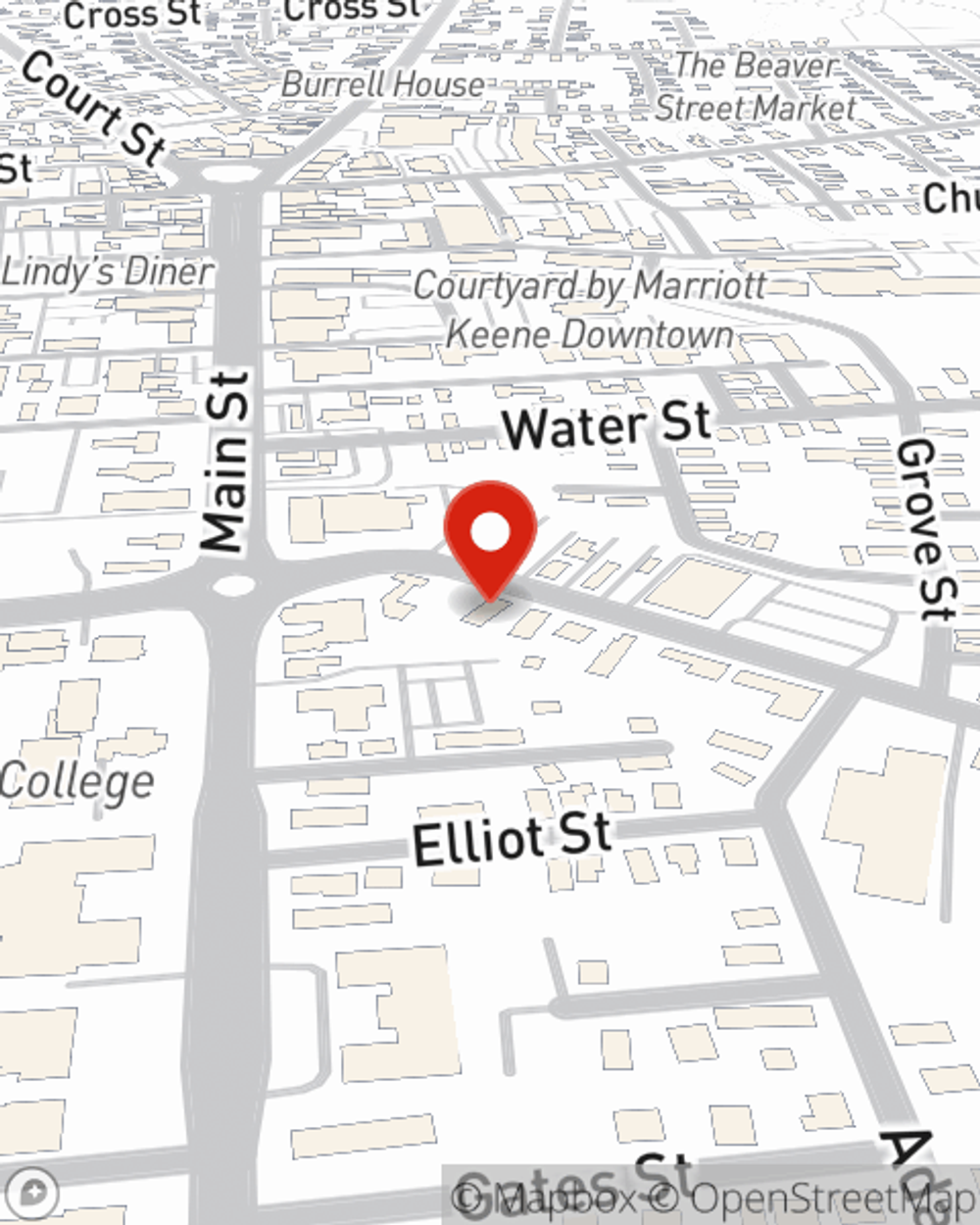

Homeowners Insurance in and around Keene

Protect what's important from unplanned events.

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Would you like to create a personalized homeowners quote?

- Keene

- Peterborough

- Cheshire County

- Swanzey

- Rindge

- Chesterfield

- Westmoreland

- Brattleboro

Home Sweet Home Starts With State Farm

Everyone knows having fantastic home insurance is essential in case of a hailstorm, ice storm or tornado. But homeowners insurance is about more than covering natural disaster damage. Another valuable component home insurance is that it also covers you in certain legal cases. If someone is injured on your property, you could be required to pay for physical therapy or their hospital bills. With adequate home coverage, your insurance may cover those costs.

Protect what's important from unplanned events.

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Why Homeowners In Keene Choose State Farm

With this great coverage, no wonder more homeowners embrace State Farm as their home insurance company over any other insurer. Agent Greg Carlson would love to help you find a policy that fits your needs, just contact them to get started.

For terrific protection for your home and your belongings, check out the coverage options with State Farm. And if you're ready to get a quote on a home insurance policy, call or email State Farm agent Greg Carlson's office today.

Have More Questions About Homeowners Insurance?

Call Greg at (603) 352-4081 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Why should I consider doing home insurance reviews annually?

Why should I consider doing home insurance reviews annually?

You should review your home insurance coverage regularly to ensure you are properly covered. Here are some tips to have a good insurance review.

Reduce your home’s carbon footprint with solutions for a more sustainable home

Reduce your home’s carbon footprint with solutions for a more sustainable home

State Farm teams up with WattBuy to calculate your home carbon footprint to find renewable energy options in your area.

Greg Carlson

State Farm® Insurance AgentSimple Insights®

Why should I consider doing home insurance reviews annually?

Why should I consider doing home insurance reviews annually?

You should review your home insurance coverage regularly to ensure you are properly covered. Here are some tips to have a good insurance review.

Reduce your home’s carbon footprint with solutions for a more sustainable home

Reduce your home’s carbon footprint with solutions for a more sustainable home

State Farm teams up with WattBuy to calculate your home carbon footprint to find renewable energy options in your area.